Unveiling the Conveniences of Opting for Offshore Business Development

Exploring the world of overseas company development unveils a myriad of benefits that can substantially impact services and individuals alike. From tax benefits to enhanced possession defense, the appeal of overseas company development lies in its capacity to maximize economic methods and expand international reach.

Tax Obligation Advantages

In addition, overseas business can engage in tax obligation planning strategies that may not be available in their residential countries, such as utilizing tax treaties between territories to minimize withholding taxes on cross-border transactions. This flexibility in tax preparation permits services to improve their global procedures while managing their tax direct exposure effectively.

In addition, offshore companies can gain from possession protection advantages, as properties held within these entities might be secured from specific legal insurance claims or creditors. This added layer of security can safeguard company properties and preserve riches for future generations. On the whole, the tax obligation benefits of developing an overseas company can supply organizations an one-upmanship in today's global industry.

Asset Protection

Enhancing the security of service possessions with strategic preparation is a key purpose of offshore company formation. Offshore entities offer a robust structure for safeguarding possessions from potential threats such as legal actions, financial institutions, or political instability in residential jurisdictions. By developing a company in a stable offshore jurisdiction with positive possession defense companies, legislations and people can shield their wealth from different hazards.

One of the key advantages of offshore business formation in terms of asset protection is confidentiality. Many offshore jurisdictions supply stringent privacy legislations that enable business to preserve privacy regarding their ownership structure. offshore company formation. This discretion makes it challenging for exterior events to identify and target details properties held within the offshore entity

Additionally, overseas structures usually have arrangements that make it challenging for financial institutions to accessibility properties held within these entities. Via legal mechanisms like property security trust funds or specific stipulations in company records, people can include layers of security to guard their riches from potential seizure.

Raised Privacy

Additionally, numerous overseas jurisdictions do not need the disclosure of helpful proprietors or investors in public documents, including an additional layer of privacy defense. This privacy can be particularly advantageous for top-level individuals, entrepreneurs, and organizations seeking to stay clear of unwanted focus or safeguard sensitive financial info. On the whole, Look At This the raised privacy offered by offshore firm development can supply assurance and a feeling of safety and security for those seeking to keep their monetary events discreet and protected.

International Market Accessibility

With the establishment of an offshore firm, services get the tactical benefit of go to my blog using international markets with boosted ease and effectiveness. Offshore company development gives business with the possibility to access a more comprehensive client base and explore new business potential customers on an international scale. By establishing operations in offshore territories recognized for their business-friendly policies and tax obligation incentives, companies can expand their reach beyond residential borders.

Worldwide market access through offshore firm development also allows companies to develop international trustworthiness and presence. Running from a jurisdiction that is acknowledged for its stability and pro-business environment can improve the track record of the business in the eyes of international partners, capitalists, and consumers. This increased trustworthiness can open doors to collaborations, partnerships, and possibilities that might not have actually been quickly accessible via an exclusively domestic business technique.

Additionally, offshore companies can benefit from the diverse series of sources, abilities, and market understandings readily available in different components of the world. By leveraging these international sources, organizations can obtain an one-upmanship and stay in advance in today's interconnected and dynamic company landscape.

Legal Conformity

Sticking to legal conformity is critical for overseas business to make sure regulatory adherence and danger reduction in their operations. Offshore firms have to browse an intricate regulatory landscape, frequently based on both local regulations in the jurisdiction of consolidation and the international legislations of the top article home country. Failure to follow these lawful demands can cause severe repercussions, including penalties, lawful actions, or also the retraction of the overseas firm's license to run.

To keep lawful conformity, overseas firms commonly involve lawful specialists with knowledge of both the local policies in the offshore territory and the worldwide legislations appropriate to their operations. These lawyers assist in structuring the overseas company in a way that makes certain conformity while optimizing functional performance and earnings within the bounds of the regulation.

Additionally, staying abreast of progressing lawful needs is crucial for overseas firms to adapt their operations accordingly. By prioritizing legal compliance, overseas business can develop a solid foundation for sustainable growth and long-lasting success in the global market.

Conclusion

Finally, overseas firm formation offers numerous benefits such as tax advantages, property security, increased personal privacy, worldwide market gain access to, and legal compliance. These advantages make overseas business an eye-catching option for companies seeking to expand their operations internationally and optimize their financial strategies. By benefiting from overseas company development, companies can boost their one-upmanship and setting themselves for lasting success in the worldwide industry.

The facility of an overseas company can provide significant tax advantages for services seeking to maximize their monetary frameworks. By establishing up an offshore firm in a tax-efficient territory, companies can lawfully lessen their tax obligation liabilities and preserve more of their revenues.

In general, the tax benefits of developing an overseas business can provide businesses an affordable edge in today's international market. offshore company formation.

Enhancing the safety and security of business possessions via tactical preparation is a main goal of overseas firm development. Offshore company formation supplies firms with the opportunity to access a more comprehensive client base and discover brand-new company potential customers on a worldwide range.

Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Jenna Von Oy Then & Now!

Jenna Von Oy Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! David Faustino Then & Now!

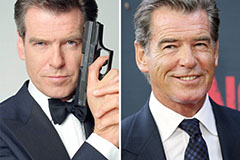

David Faustino Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!